how are rsus taxed in india

Generally there is no double taxation since US MNCs with employees in India generally submit W-8BEN to US brokers to avoid any withholding related to US taxes. RSU tax at vesting date is.

How Does Tax Work With Rsu If I M Working In Seat Fishbowl

In such a situation where an employee exercise shares under an RSU he needs to pay tax on the perquisites in the foreign country ie the country in which the taxable RSU.

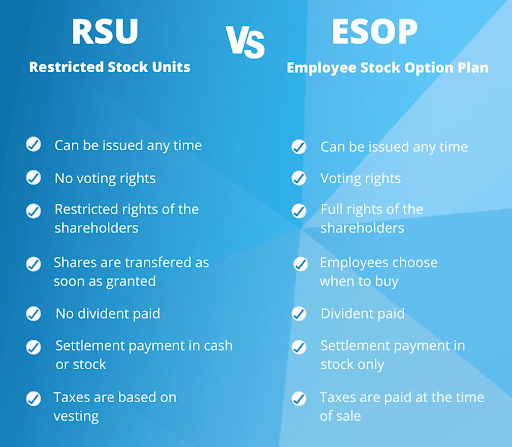

. When you receive RSUs as part of your compensation they are taxed as. The employee is taxed on restricted stock upon grant and on RSUs upon vesting may include personal assets tax. Restricted stock units are equivalent to owning a share in your companys stock.

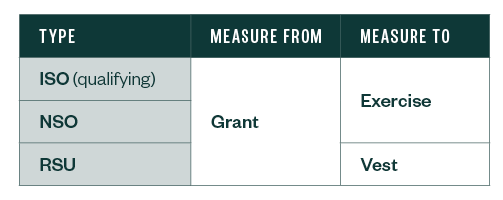

RSU Taxes - A tech employees guide to tax on restricted stock units. This is different from incentive stock. However if there double.

RSUs offer several benefits to a companys employer and employees. How it works in Google MicrosoftAdobeAmazon Walmart and what will be effective tax on allocated RSUs. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income.

How Are Restricted Stock Units RSUs Taxed. Also restricted stock units are subject. Listed below are some of the benefits of restricted stock units you need to consider.

Those plans generally have tax consequences at the date of exercise or sale whereas restricted stock usually becomes taxable upon the completion of the vesting. Restricted stock units are equivalent to owning a share in your companys stock. Carol Nachbaur April 29 2022.

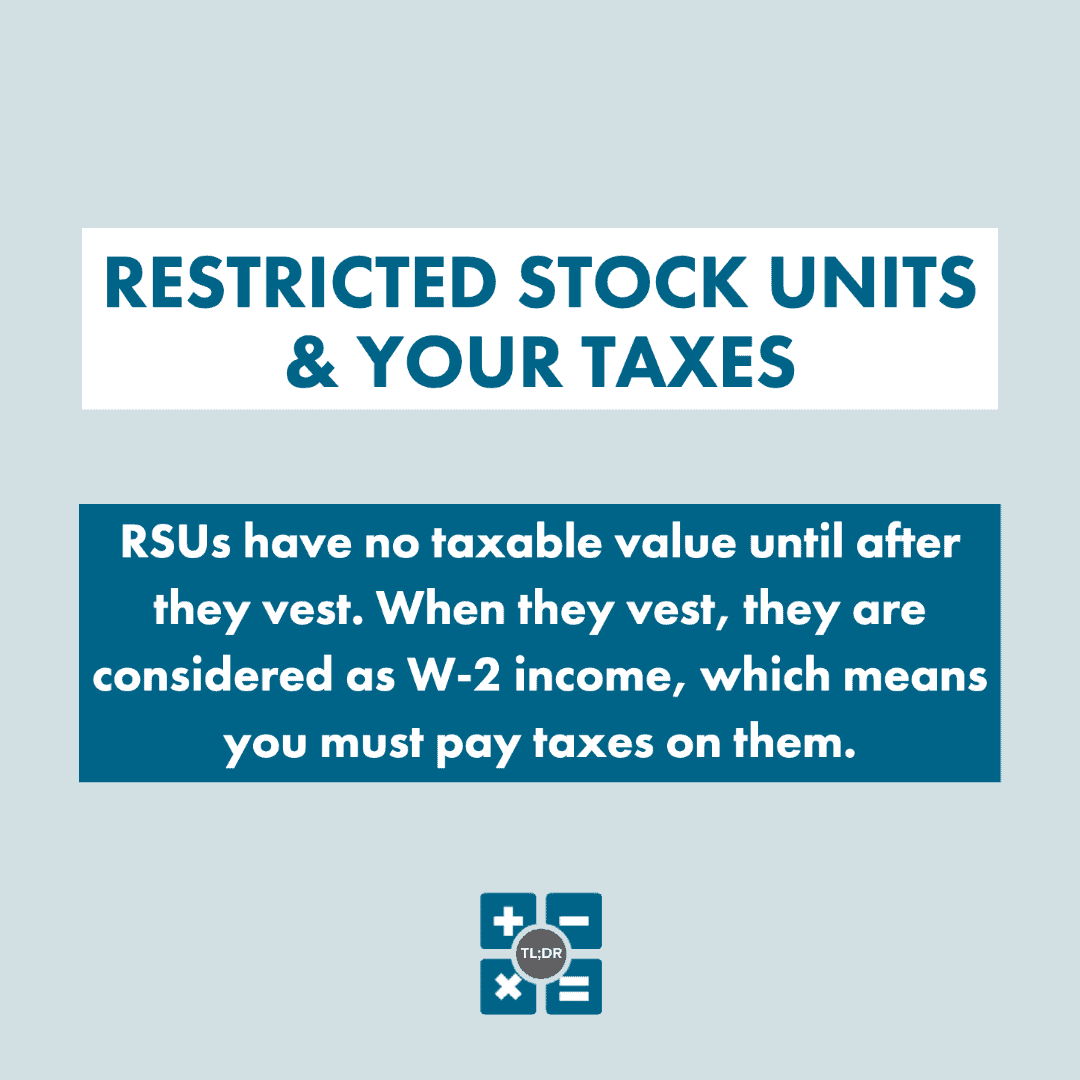

Why are RSU taxed so high. Restricted stock units are equivalent to owning a share in your companys stock. If held beyond the vesting date the RSU tax when shares.

How will RSU be taxed. The employee is subject to a flat tax of 15 percent on any net gain. When you receive RSUs as part of your compensation they are taxed as.

When you receive RSUs as part of your compensation they are taxed as. When you receive RSUs as part of your compensation they are taxed as. Why are RSU taxed so high.

Why are RSU taxed so high. The of shares vesting x price of shares Income taxed in the current year. Foreign RSUstock tax calculator.

Since RSUs are not a capital asset or financial or equity interest until vested these can be reported as part of other assets in schedule FA in your income tax return. Many employees receive restricted stock units RSUs as a part of. What are the taxation rules for RSUs in India.

With RSUs you are taxed when the shares are delivered which is almost always at vestingYour taxable income is the market value of the shares at vesting. Why are RSU taxed so high. Restricted stock units are equivalent to owning a share in your companys stock.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

Tax Planning For Stock Options

Restricted Stock Units Rsus Facts

Restricted Stock Unit Rsu Tax Strategies To Save On Tax Bill In 2022 Trica Equity Blog

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Tax What Is Tax Taxation In India Tax Calculation

Rsu Espp And Esop Understanding Meaning And Taxation

Rsu Of Mnc Perquisite Tax Capital Gains Itr

All About Rsus Shares Taxes Applicable What Happens After 4 Years Truth Behind Rsus Youtube

Restricted Stock Unit Taxes Your W 2 Everything Else You Should Know Tl Dr Accounting

Double Tax In India For Rsus Blind

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted

Taxability Of Esop Rsu And Espp For Indian Residents Youtube

How State Residency Affects Deferred Compensation

Taxation When Rsu And Espp Were Awarded Vested In One Country And Sold In Usa

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Rsu Taxes Explained 4 Tax Strategies For 2022